Play all audios:

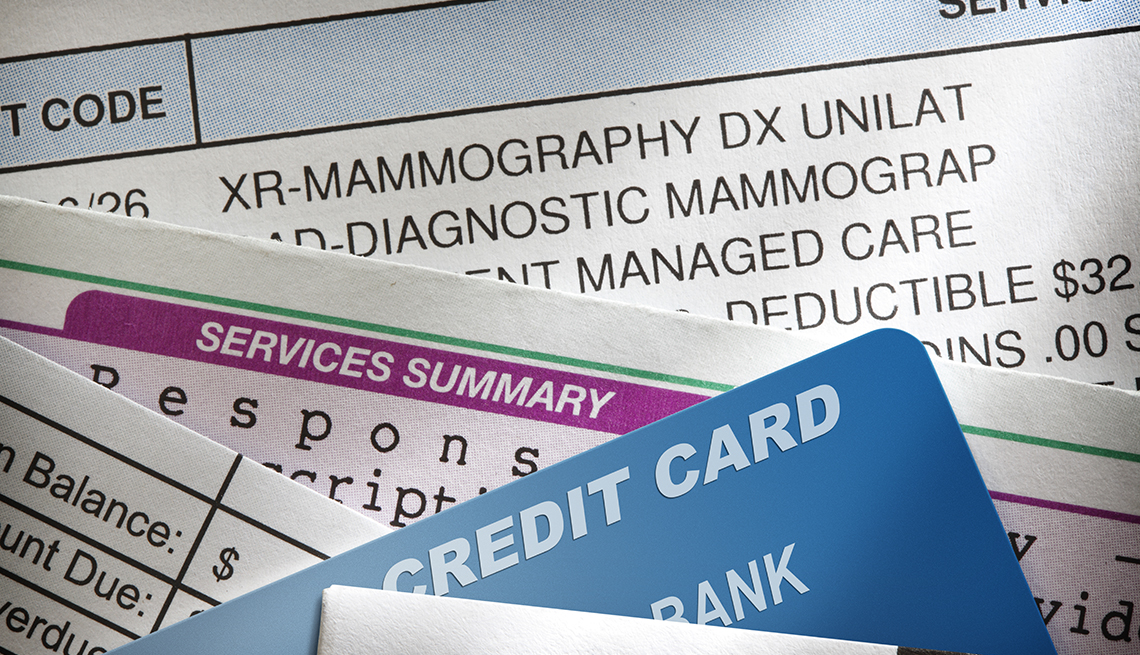

If there is anyone on planet Earth who should be able to handle medical billing issues, it is Miranda Yaver. The visiting assistant professor at Ohio’s Oberlin College has a Ph.D., spent

two years doing postdoctoral work at UCLA’s Fielding School of Public Health, and is even writing a book about medical claim denials. But even with such a tailor-made résumé, she discovered

that over $11,000 in wrongly denied claims had found their way onto her credit report. The hospital had sent it to collections while the issue was still being appealed. “This is my area of

expertise, and even I am getting the runaround,” Yaver marvels. “How can a single mother working a couple of jobs possibly handle this stuff? The answer is they probably can’t.” Yaver is

hardly alone. According to a new report from the Consumer Financial Protection Bureau (CFPB), there is roughly $88 billion in medical debt appearing on 43 million credit reports. In fact,

as of 2021’s second quarter, a whopping 58 percent of the debts that are in collections and haunting people’s credit reports are medical bills. “It’s a huge problem, especially with the

pandemic,” says Beverly Harzog, a credit expert for_ U.S. News & World Report_ and author of _The Debt Escape Plan_. “So many people have had hospital bills the last couple of years

that they have had trouble paying off,” she adds. “A lot of times it ends up on your credit report — and once it’s there, it’s hard to get off.” RACE AND MEDICAL DEBT * 27.9 percent of Black

households carry medical debt, compared to 17.2 percent of white households and 9.7 percent of Asian households * 1 in 3 Black adults have past-due medical bills, compared to fewer than 1

in 4 white adults * 17 percent of Black adults lack health insurance compared to 12 percent of white adults Source: National Consumer Law Center The scope of the problem has become so bad

that the major credit agencies swung into action shortly after the CFPB report was released. Experian, Equifax and TransUnion announced a handful of new measures: Starting July 1 of this

year, for instance, paid-off medical collection debt will no longer appear on consumer credit reports. In addition, the time period before unpaid medical debts can be reported will increase

from six months to one year. And starting in the first half of 2023, amounts below $500 won’t appear on credit reports at all. Combined, these measures are projected to reduce medical debt

on credit reports by nearly 70 percent. It’s cold comfort, though, for the millions of Americans who have already been dealing with this issue. Here’s why it is so problematic: Negative

notices on your credit report drive down your credit score, which is what lenders look at when they evaluate you for loans. “Negative credit can affect almost everything,” says author and

credit expert Gerri Detweiler. “Mortgages, auto loans and credit cards become more expensive. It can mean bigger deposits if you are opening utility accounts. It can make it more difficult

to rent an apartment. It can even make it more difficult to get a job.” If you have a very good score — of 740 or higher, for example — you will typically qualify for the most attractive

rates when taking out a loan for big purchases like a home or a car. But the lower your score, the higher the rates lenders will charge you. Over the course of a home loan, even a small

differential could cost tens of thousands of dollars.