Play all audios:

Here are the biggest calls on Wall Street on Friday: Loop initiates coverage of Playboy as buy Loop said Playboy's transformation will pay off. " PLBY is undergoing a

transformational shift as the company pivots away from its traditional brand licensing model and expands its direct product sales. While near-term gross margin upside could be capped (in

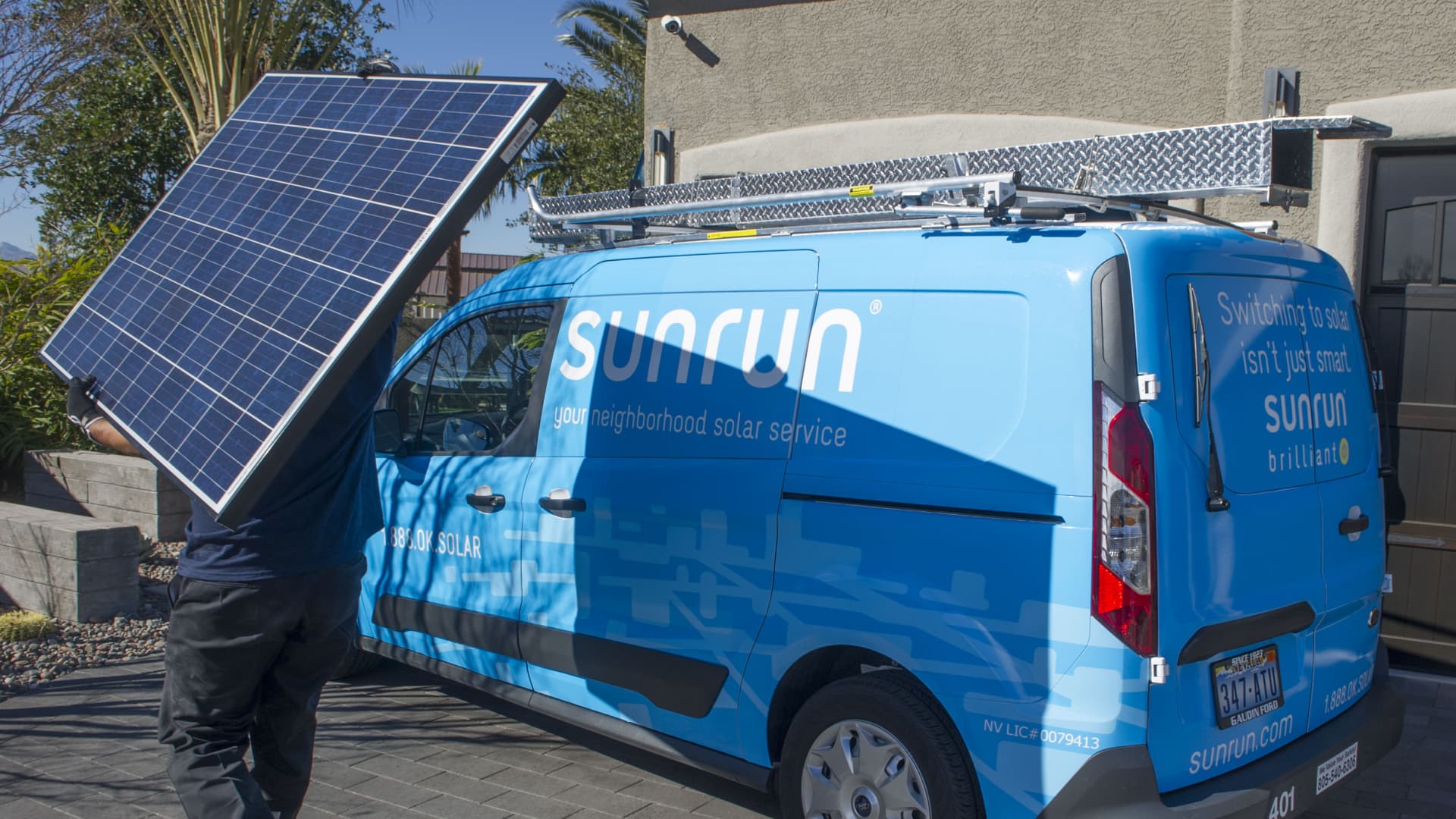

percentage terms at least) due to mix, we believe PLBY's DTC strategy will pay off in the medium-to long-run." BMO initiates coverage of Sunrun and Sunnova as outperform BMO said

the solar stocks are "well positioned for the energy transition." "While their customer acquisition strategies differ ( NOVA r elies on third-party dealer network, RUN a

multichannel marketing approach) their approach to distinguishing themselves via service, offering customers technology to manage home energy consumption is well positioned for the energy

transition era and the opportunity for both is positive." Citi upgrades General Mills to buy from neutral Citi said in its upgrade of the food products company that investors are

overlooking the stock, especially after its solid earnings report last week. " GIS delivered a much better-than-expected fiscal 1Q last week, and the market barely noticed. We think

that this is a good story in a tough sector that deserves a second look." Read more about this call here. RBC initiates coverage of Amazon, Facebook, Alphabet and Snap as outperform

Beginning its coverage of Amazon , Facebook , Alphabet and Snap , RBC said it favors "most platforms with dominant user engagement and bottom or down-funnel opportunities" that

will drive long-term value. "With several trillions of dollars of consumers spending expected to shift online in the coming years, we believe digital advertising will be one of the

biggest beneficiaries as digital advertising dollars have historically tracked in parallel to incremental e-commerce spending." BMO initiates coverage of Enphase and SolarEdge as

outperform Kicking off coverage of Enphase and SolarEdge , BMO said both companies are in the "early stages of deploying residential battery systems that are a high demand product for

solar consumers." "These companies are suppliers of what is an increasingly vital component of residential solar systems, inverters. We see both companies and their core product of

inverters and modular level power electronics (MLPEs) as notably differentiated from other solar manufacturing and component businesses by the technological content of their products."

Morgan Stanley resumes Lordstown Motors as equal weight Morgan Stanley resumed coverage of the electric vehicle company and said Lordstown needs to maximize the value of its manufacturing

plant. "We reinstate our rating on RIDE at EW, driven by new management and a stated strategy to explore strategic alternatives, including maximizing the value of the plant. While risks

remain, we believe RIDE's EV/unit of technical capacity of$2.5-$3k may provide valuation support. KeyBanc downgrades Dollar Tree to sector weight from overweight KeyBanc said that

it's concerned about cost pressures. "However, over the next 6-12 months, we are increasingly concerned these efforts will not offset cost pressures (including freight and labor,

which we discuss in a separate note today) and risk from lapping stimulus payments. We downgrade DLTR to SW on an unfavorable risk/reward over this time horizon." Morgan Stanley

reiterates Disney as overweight Morgan Stanley said it thinks Disney+ subscriber additions will accelerate. "We see Disney on the short list of global streaming majors. Despite

significant continued upward earnings revisions, shares have lagged as net adds expectations ran ahead of content deliveries. As the content pipeline builds into '22 and '23, core

net adds should accelerate, driving shares." JPMorgan resumes Philip Morris as overweight JPMorgan resumed coverage of the tobacco company and said it's well positioned in the near

and long term. "The global leader in both cigarettes and Heated Tobacco Products, PMI is set to cash in on its $8.1bn of cumulative NGP (next generation products) investments. UBS

initiates coverage of Anaplan as buy UBS said it sees a positive risk/reward for the business-planning software company. "We have consistently heard that back-office application

initiatives have been less of a near-term priority and slower to recover during the pandemic, yet we believe that PLAN' s 2QF22 results combined with our +15 partner and customer checks

suggest that a recovery in deal activity is beginning to materialize and has the potential to be stronger in 4QF22/1HF23." Deutsche Bank adds a catalyst buy on Blade Air Mobility

Deutsche added a catalyst call buy idea on the urban air mobility platform and said it sees the positive momentum continuing. "While shares of Blade Air Mobility (BLDE) are up nearly

20% since early September, we think the positive momentum will continue (particularly over the next 3-4 months) as the company achieves its goal of completing two accretive acquisitions over

the next few months." JPMorgan upgrades Southwest to overweight from neutral JPMorgan said in its upgrade of the stock that it sees a "particularly attractive" risk/reward.

" Southwest possesses the industry's deepest track record of profitability, the highest quality balance sheet, and a fiercely loyal customer base. We believe Southwest has ample

liquidity to endure the COVID-19 crisis, and at current levels we think risk/reward is particularly attractive." Read more about this call here. Bank of America downgrades Canopy Growth

to neutral from buy Bank of America said in its downgrade of the cannabis company that it sees profitability risks ahead. "We remain bullish on CGC 's long-term potential and

think its best positioned among Canadian producers to enter the US upon federal legalization. However, we see near- term risk to its F2H22 profitability outlook because its BioSteel roll-out

and Canada cannabis production ramp are currently lagging plan." Susquehanna downgrades MGM to negative from neutral Susquehanna said in its downgrade of MGM that

"DraftKing's bid for Entain disrupts MGM's most important value driver." "We see DKNG's bid for Entain as consistently aggressive, out-maneuvering MGM for

control of BetMGM and weakening its digital prospects in all likely scenarios." Raymond James downgrades Alibaba to outperform from strong buy Raymond James said it sees a long-term

recovery in shares for Alibaba. "While we remain positive on Alibaba long-term and believe valuation remains attractive we believe the recovery in shares could take longer given the

recent slowing of ecommerce growth combined with continued regulatory actions across China." Guggenheim raises price target on Netflix to $685 from $600 Guggenheim raised its price

target on Netflix and kept its buy rating. The bank said the streaming company is a "powerful global content machine." "As we have previously noted, the company's focus

on developing a sustainable global asset base should further strengthen its content development leadership position, driving member growth and pricing power." Jefferies initiates

coverage of IBM as buy Jefferies said it sees a "solid path for IBM to outperform growth expectations." "We're initiating coverage on IBM with a Buy rating and $170 PT.

We see a strong demand environment driven by pandemic recovery and enterprise focus on digitization and digital resiliency." Credit Suisse reiterates General Motors as outperform Credit

Suisse said it's bullish on the automaker heading into its investor day next week. "With GM set to host its investor day next week, we expect it to highlight its growth

opportunities, making the case for multiple expansion. We expect the event to reinforce our positive outlook on GM, though it may take time for investors to more widely underwrite the

sum-of-the-parts opty." Piper Sandler reiterates Snap as a top pick Piper Sandler kept Snap as a top pick and said hiring trends are a positive read on digital advertising momentum.

"With the help of our Piper Sandler data science team, we analyzed job postings data for jobs at our Digital Advertising companies under cover including Alphabet (GOOGL), Facebook (FB),

Twitter (TWTR), Snapchat (SNAP), and Pinterest." JPMorgan reiterates Target as a top pick JPMorgan reiterated Target as a top pick and said it's a key beneficiary of the recovery.

"From a stock perspective, we are focused on: (1) names that have continued supportive 2022 recovery dynamics (e.g., miles driven/used car pricing, apparel and beauty consumption); (2)

companies with near-term pricing power and relatively lower freight risk (3) companies that have fewer competitors post-COVID-19 and/or are retaining customers with the least share of

wallet reversion risk." Barclays upgrades Xcel Energy to overweight from equal weight Barclays said in its upgrade of the energy company that it's bullish on Xcel's transition

to renewables. "We upgrade XEL to Overweight with a $76 price target given the company's geographic attributes, favorability in the transition to renewables, and potential capital

initiatives driving incremental growth." Barclays downgrades Joann to underweight from equal weight Barclays said in its downgrade of the fabric retailer that it's concerned about

pent-up demand for arts and crafts subsiding as the economy reopens. "The top risk to JOAN when we initiated was the degree to which reopening would lead to attrition in arts and

crafting trends given pent-up consumer demand for experiences, and we believe it is now likely to worsen when more of the economy ultimately reopens."