Play all audios:

ABSTRACT Venture capital is an essential financing option for small and medium-sized enterprises, especially high-tech enterprises. The sustainable development of enterprises is of great

significance for promoting the high-quality growth of the economy. In this paper, Chinese-listed companies supported by venture capital from 2002 to 2022 are taken as the research sample.

Semiparametric and nonparametric methods are adopted to explore the long-term impact of venture capital on the sustainable development of Chinese enterprises. It is found that the early

stage of venture capital companies has a significant promoting effect on the sustainable development of the enterprises. In contrast, professionalism has no significant impact on the

sustainable development of enterprises in the short term but has an inhibitory effect in the long term. The results show that venture capital is conducive to enterprises’ standardization and

long-term development because it provides funds, supervision, and other noncapital value-added services, such as networking resources, management experience, and market information. Venture

capital should refrain from interfering excessively in decision-making in professional and technical fields. This paper addresses the need to research venture capital’s impact on

enterprises’ sustainable development. It provides a specific reference for formulating venture capital contracts and related policy recommendations. SIMILAR CONTENT BEING VIEWED BY OTHERS

HOW SMART CITY BUILDING IMPROVED CORPORATE PERFORMANCE: EMPIRICAL EVIDENCE OF CHINA’S A-SHARE LISTED COMPANIES Article Open access 07 December 2023 FINANCING PREFERENCES AND PRACTICES FOR

DEVELOPING SUSTAINABLE EXHIBITIONS IN CHINESE COMPANIES Article Open access 12 December 2023 CAN DIGITAL FINANCE CURB CORPORATE ESG DECOUPLING? EVIDENCE FROM SHANGHAI AND SHENZHEN A-SHARES

LISTED COMPANIES Article Open access 26 November 2024 INTRODUCTION As the engine of national economic and social development, SMEs expand employment, improve people’s livelihoods, promote

innovation, and promote high-quality economic developmentFootnote 1. The 2022 Report on the Work of the Chinese Government noted that it is necessary to deepen enterprises’ development,

promote science, and enhance enterprises’ core competitivenessFootnote 2. The financing and sustainable development of SMEs have always been the focus of the government and scholars. The

main reasons for the difficulties that SMEs face in obtaining financing are the great demand for funds, the extended return period, the high risk, and the lack of mature and effective

management and supervision mechanisms, which have severely hindered the sustained development of SMEs (Feng 2017). Compared with traditional financing channels, venture capital’s unique

staged investment contract model, long-term benefits, and unique value-added services align with SMEs’ needs. Venture capital makes up for the deficiencies of traditional investment. It

promotes the transformation of technological innovation achievements into the competitive advantages of SMEs. Industrialization provides a strong guarantee for the sustainable development of

enterprises, which supports economic development (Ma and Zhang 2013). Venture capital in China started relatively late. Affected by the requirements of company system entry and exit

policies, it is easy for SMEs and venture capital companies to lack mutual understanding and trust. This article explores the impact of venture capital from the perspective of the length of

time and the breadth of the scope of influence, namely, the length of time for venture capital to enter and the scope of venture capital’s areas of expertise, which are called early-stage

and professionalism, respectively. The early stage explores whether venture capital that enters the investee firm at an early stage benefits the enterprise’s development. Professionalism

explores whether venture capital companies that focus on one or several industries impact the sustainable development of enterprises. The goal is to give choices and decisions between SMEs

and venture capital policy to provide reference. In particular, the survival analysis method is chosen as the primary method in this paper. Survival analysis is a dynamic research method

that is often used in biology, medicine, engineering, and other fields. The application in the financial economy field is in the exploratory research stage. It is mainly used in early

financial warning, enterprise survival analysis, unemployment duration, and labor migration (Klein et al. 2013). Survival analysis can describe an investee enterprise’s survival performance

in the stock market and overcome censoring data. This paper focuses on the early-stage and professional characteristics of venture capital events in China in the past 20 years. It explores

the long-term impact of venture capital on the sustainable development of Chinese enterprises. The significance and contribution of this paper can be explained in terms of two aspects of

theoretical and practical significance. This paper has important theoretical significance in the field of long-term impact research. The long-term influencing factors and results of venture

capital investment are complex and challenging to define. Moreover, many factors affect the outcome of venture capital investment. It is worthwhile to consider choosing a suitable research

method and dependent, independent, and control variables. This paper addresses this methodological issue. First, we chose the survival analysis method to study long-term effects. Survival

analysis methods are commonly used in biological research, and we have realized the application of interdisciplinary methods. Second, we clearly defined our study variables, namely, survival

status and survival duration, as outcomes for long-term effects. At the same time, the essential characteristics of venture capital, namely, professionalism and early stage, are selected

for this paper to represent the length of the impact time and the breadth of the impact range. Under this model, we can select control variables well and remove individual differences.

Moreover, this model provides methods and ideas for research on the sustainable development of enterprises. This article also has important practical significance. The first is its

significance to China. This article provides a profound understanding of venture capital and has a specific guiding role for investors and financiers. It guides investors and investees to

initiate venture capital activities as soon as possible while paying attention to the degree of fit between the two parties, especially in the investment field of venture capital. Moreover,

many scholars focus on the short-term effects of venture capital, and there are some disputes about the conclusions. Some promising SMEs often hesitate to seek venture capital. This article

provides positive conclusions through empirical analysis, which can give confidence to investors and financiers. Furthermore, this article can rouse the government’s attention to venture

capital. Second, regarding international investors, China has a large market, many investment opportunities, and frequent venture capital events. This article can guide investors from

various countries and help them better understand the Chinese market. LITERATURE REVIEW Venture capital positively influences SMEs’ success, providing capital and value-adding services

(Gutmann et al. 2019). Moreover, the impact of venture capital is far more significant than that. The entry of venture capital will increase high-tech enterprises’ research and development

expenditure, promote innovation and commercialization in the short term, and significantly improve performance (Kelly and Kim 2016; Chen et al. 2017). Venture capital with a transnational

background can also help companies thoroughly explore domestic and international markets and improve globalization (Wang and Zhuang 2021). Domestically, the involvement of venture capital

expands the scale of mergers and acquisitions in different areas and promotes the flow of capital across regions (Yu et al. 2022). Venture capital’s advisory and oversight role plays a

quality certification role in IPOs, increasing the IPO premium (Chahine et al. 2018). It is more important to explore the effect of venture capital on the long-term sustainable development

of enterprises than to examine the impact of venture capital on IPOs. SMEs lack mature management mechanisms, financial capabilities, and information resources. SMEs cannot benefit from the

economy, which hinders their sustainable contribution to the economy (Khattak 2019). Many studies have confirmed that venture capital significantly impacts the development and listing of

SMEs. Nevertheless, there is little research on venture capital’s impact on enterprises’ sustainable development after listing. Listing is the goal of the enterprise development stage.

Sustainable development, that is, remaining active, competitive, and recognized after listing, is the ultimate goal of enterprises (Mingaleva et al. 2022; Militaru et al. 2021). The existing

research conclusions on the long-term impact of venture capital are divided. Jain (2001) used a series of univariate and multivariate logit tests to demonstrate that multiple VC

characteristics, such as long-term commitment, coordination of management strategies, and early involvement, can increase a company’s post-IPO success. Zhang and Zhang (2020) used China

A-share market data to verify that venture capital can promote the long-term market performance of IPO companies by driving innovation. However, Darrough and Rangan (2005) believe that

venture capitalists are more concerned about earning high returns than about the performance of companies after IPOs, which is why venture capitalists sell stocks after IPOs. With the exit

of venture capital, the market will become suspicious of listed companies, affecting other investors’ confidence. This may also lead to a company performance decline, leading to a stock

decline. Wang et al. (2003) also believed that although venture capital can promote a better enterprise listing, it is not conducive to operating performance after listing. Using the

Fama-French model, Buchner et al. (2019) indicated that IPOs backed by venture capital underperform those buyouts backed in the long run. VC reputation is strongly associated with portfolio

company success in the short term, but its impact has diminished significantly over a long time (Mahto et al. 2018). The characteristics and methods of investigating venture capital in

existing research cannot be used to show the role of venture capital in the long-term process. The market performance at a specific time cannot represent whether the enterprise can develop

sustainability. Appropriate variables and long-term dynamic research methods are needed, and this is what this article attempts to provide. The advantage of venture capital comes from its

unique investment model, a “nurturing” investment under the contract mechanism. Venture capital is a long-term and phased investment. This investment model can reduce the irreversible risk

of a one-time investment and play a positive incentive role (Lukas et al. 2016). The long-term and phased investment of venture capital also ensures supervision, management, and provision of

value-added services. Compared with traditional investment, supervision mechanisms and value-added services have essential differences. Venture capital usually uses its information,

advantages, and experience to provide value-added services to its investee company. At the same time, it supervises the significant decisions of the investee company, better addresses

uncertainty, improves the investee company’s performance, and improves its investment return (Dong and Wang 2017; Dong et al. 2017). The advantages and experience of venture capital continue

to accumulate throughout the investment process. Before a venture capital company makes an investment, regulatory rules are established under its regulatory system. Based on these detailed

rules, decision-making and financial control power, which facilitate convenient supervision after investment, are established (Arcot 2014). After making an investment, the venture capital

firm has a large share of equity, usually serves as a board of directors and supervisor member, and actively participates in the investee enterprise’s decision-making process involving

significant decisions (Zhao 2014). The venture capital firm supervises enterprise management and financial risks, learns continuously from the current investment environment, makes

reasonable decisions, and promotes investment efficiency (Chen and Xie 2011). Value-added services include market expansion and information sharing and are part of the external operations of

enterprises. Venture capital firms use their interpersonal networks to provide market information to start-ups and build business platforms. They help the companies in which they invest

find customers, upstream and downstream companies, and even listed sponsors and underwriters. Therefore, venture capital improves investee enterprises’ operating efficiency and rapidly

increases their value (Vanacker et al. 2013). Information sharing is reflected in the internal management of enterprises, and venture capital provides management experience and financial

advice. Venture capital firms utilize their experience and resources to recommend management talent to the companies in which they invest and provide financial advice and management

frameworks (Tian et al. 2016). Venture capital firms have more substantial information collection and analysis capabilities than other companies, and their rich investment experience and

detailed industry and market information can be used to predict future development more accurately, which is conducive to promoting the smooth progress of the project (Colombo et al. 2016).

At the same time, using a venture capital firm’s experience and reputation as a channel for communication between investment and financing parties can enhance investor confidence, increase

external cooperation opportunities (Lu et al. 2011) and reduce the problem of internal and external information asymmetry. Enterprises with venture capital participation have better

financial performance after IPO and achieve better long-term performance (Sincerre et al. 2019). Venture capital is conducive to enterprise innovation, intellectual capital, and professional

operation (Pradhan et al. 2017; Meng et al. 2023). From the perspective of organizational performance, venture capital improves corporate governance, brings faster growth, reduces the

possibility of financial distress, and improves survival (Campbell and Frye 2009). In addition, start-up investors and some internal managers hope that companies can realize their

shareholding goals through commercialization. Companies with venture capital participation are more likely to realize commercialization through IPOs or mergers. In the IPO stage, companies

with venture capital have lower discount rates (Hsu 2006). This paper argues that venture capital, whether for IPOs or postlisting sustainable development, has an important impact on small

and medium-sized enterprises. Core competitiveness, perfect management, financial systems, excellent corporate culture, and internal cohesion are necessary for enterprise growth and

development process. More importantly, a strong relationship network is needed to support development in the future, and these venture capital investments can help. Survival analysis is a

statistical method that is used to study the occurrence and duration of single or multiple events. The survival duration and the event outcome (individual death or event failure) are

included in the model. It can be used to describe the distribution characteristics of survival time or analyze the main factors influencing the results (Klein et al. 2013). In this paper, a

survival analysis model is constructed using duration analysis applicable to economics. Duration analysis is often used to study failure events such as patient death in the medical field. It

was initially extended to economics through unemployment studies (Lancaster 1979) and hedge fund survival (Malkiel 1995). Survival analysis methods include nonparametric, parametric, and

semiparametric methods. The nonparametric method, Kaplan‒Meier, and the life table method were used in this study to describe the survival curve of the company after listing and to analyze

its survival characteristics. The nonparametric method is used to study and assess the impact of risk factors on survival time, with no assumptions requirements about the observed sample

distribution. All three methods can be used to estimate the survival function, but there are differences (Klein et al. 2013). The survival analysis method is a dual study of survival time

and outcome. The Cox proportional hazards regression model is selected. Moreover, the nonparametric method is used to test the results. The reasons are as follows: general regression methods

have strict normal distribution and variance conditions for the data. In contrast, the data in this study contain a large number of censored data and categorical variables, and the

distribution of survival time does not meet the requirements of general regression method assumptions. The Cox proportional hazards regression model can avoid these problems. The

distribution of survival time does not need to be known in advance. Its distribution law can also be used to obtain a more precise relationship between research factors and survival time.

When using the Kaplan‒Meier survival estimation for analysis, the model does not consider other variables and only focuses on the relationship between univariate and survival time. It is a

univariate analysis with intuitive performance in the testing. DATA AND ANALYSIS VARIABLES The dependent variables are listing survival time and living state. Listing survival time refers to

the time between the start of the IPO and the delisting or deadline for statistics. Living state refers to the market status, namely, merging or delisting, and active. The survival status

of Chinese listed companies can serve as an indicator of the long-term impact of venture capital on invested enterprises. The Chinese stock market system has unique characteristics. China’s

current stock listing system is censorship, so the listing procedure is complex and challenging. Small and medium-sized enterprises in China need a longer time to go public. China’s

delisting system is also unique. Enterprises’ profitability and revenue management capabilities directly affect the survival of IPOs. Delisting regulations focus less on shareholders and

more on the returns and assets of enterprises. Delisted enterprises are likely to face bankruptcy. Therefore, under this particular system, the survival status of Chinese listed companies

can be reflected in the long-term operating conditions of the invested enterprises. The independent variables are selected from the two main characteristics of venture capital: The first

category is professional or widespread. Professionalism in this study refers to the investment scope of venture capital companies. Professional venture capital companies focus on less than

or equal to 5 investment industries. Venture capital companies with more than five investment industries are known as widespread venture capital. Focusing on fewer industries provides a more

thorough understanding of the technology and information of the industry. In addition to supervising and providing appreciation, they have more time to provide professional guidance and

promote the sustainable development of enterprises. Hypothesis 1: Enterprises supported by professional venture capital companies have shorter survival times than widespread VC-backed

companies. The second category is the early stage or nonearly stage. Venture capital companies that enter the company before Round A are considered early-stage venture capital, and those

that enter the company after Round A are considered nonearly-stage venture capital. The earlier venture capital enters the listed company, the earlier the venture capital company can

supervise the company and provide value-added services. Companies are sustained and perform better as they receive their VC investment at the initial stage (Jeong et al. 2020). Hypothesis 2:

Companies backed by early-stage venture capital companies have shorter survival times than nonearly-stage VC-backed companies. Professionalism refers to the investment scope of venture

capital companies. For professional venture capital companies with less than or equal to 5 investment industries, the value is set to 1; otherwise, it is set to 0 for widespread venture

capital companies. If a venture capital company enters the investee company before or during Round A, the value is set to 1. Otherwise, it is a nonearly-stage venture capital company, and

the value is set to 0. Four control variables are selected to exclude the influence of other factors on the results in this article. The control variables include the company’s age at the

time of listing, IPO issue scale, industry performance, and the reputation of the lead underwriter. Age at the time of listing refers to the time from the company’s establishment (obtaining

a business licence) to the listing, calculated in months. Ritter (1991) noted that this time represents the enterprise development speed. It has a positive monotonic relationship with growth

rate and stock performance (Shin et al. 2022). The shorter the time is, the faster the company develops, the more competitive the company is, and the better the development prospects are.

The IPO issue scale refers to a company’s issue scale when it goes public, including common and preferred shares. Hensler et al. (1997) used a survival model to verify the positive

relationship between the IPO scale and survival. Different financing scales significantly differ in performance (Tang et al. 2017). Industry performance: The characteristics of each industry

are different, and the performance levels are also different, so the industry is an important control factor. The industry dynamic price-earnings ratio is used as the measurement standard

in this paper, and the industry classification is divided according to Wind’s data classification. Lead underwriter’s reputation: Some studies link the underwriter’s reputation to long-term

market performance following a company’s IPO. Research by Loughran and Ritter (2000) shows a positive relationship between underwriter reputation and firm performance in the market. There is

no authoritative reputation ranking for securities underwriters in China. Companies with more significant total assets tend to have better strength and reputation. Therefore, this paper

uses the total assets of the lead underwriters as an indicator to rank the underwriters, divided into the following three categories: low, medium, and high. The levels are expressed as

0-low, 1-medium, and 2-high. The survival time of the IPO of listed companies is chosen as the indicator of survival quality in this paper. Our research aims to study the long-term impact of

venture capital as a "catalyst" for survival. The control variables include the individual differences of companies before the listing. The IPO issue scale represents the

difference in enterprises’ valuation. This valuation includes the evaluation of enterprises’ profitability and management ability. The age at which the company went public represents the

difference in the maturity of enterprises. There are also differences between the industry and the underwriters. The return or income over time is regarded as the short-term impact of

venture capital. Survival status in the market and duration are the long-term impacts of venture capital. The specific variable selection summary is shown in Table 1 below. DATA ANALYSIS

There is a very authoritative enterprise database in China that is referred to as Wind Data Service. In the domestic market of China, Wind Information’s clients include over 90% of financial

enterprises, such as Chinese securities companies, fund management companies, insurance companies, banks, and investment companies. In the international market, 75% of the Qualified Foreign

Institutional Investor (QFII) approved by the CSRC are customers of Wind Information. For this paper, the venture capital events list from the Wind database from January 1, 2002, to

December 31, 2022, were collected. The listed companies in all events were selected as the research object for this paper to ensure the availability of more detailed data. The information

record lists of Chinese-listed companies were collected. This list was merged with the venture capital events list according to the information of the same enterprise. Data that could not be

merged were deleted. Finally, we obtained data from listed companies supported by venture capital. These companies also developed from small and medium-sized enterprises. While they can

have different performances in the stock market, venture capital has been involved in these enterprises for a long time because it mostly enters in the early stage and exits after listing.

The survival status and duration of these listed enterprises supported by venture capital can reflect the long-term impact of venture capital. The reasons for choosing China’s data are the

availability of data and the particularity of China’s venture capital. The scale of venture capital in China has increased rapidly, and the overall scale is enormous. Venture capital in

China started relatively late but currently has a larger scale. Many issues have emerged in the Chinese market and can serve as a reference for other countries. According to data released by

the international consulting firm Preqin Ltd, the scale of venture capital investment in China in 2021 reached 129 billion US dollars, achieving a new high, mainly in critical industries

such as semiconductors, biotechnology, and information technology. Many well-known Chinese companies, such as Alibaba, Tencent, and JD, have received help from venture capital in the early

stages. China’s economy and small and medium-sized enterprises cannot develop rapidly without the involvement of venture capital. Through the utilization of data from China, the impact of

venture capital on SMEs can be effectively reflected. The total number of companies was 1372. Most of these listed companies were listed on China’s main board, and some were listed abroad.

Among them, 116 were delisted companies, and 1256 were still actively trading in the market. In the statistical analysis, companies still active in the market take December 31, 2022, as the

cut-off time. The average issuance size of the company is 723.51 million RMB, with 438 companies above the average and 934 companies below the average. Based on the industry price-earnings

ratio, this article includes 49 companies from different industries. The reputation of underwriters is divided into three levels: low, medium, and high. Low-level underwriters account for

35.8% of the total. A total of 36.9% of underwriters are intermediate underwriters. Furthermore, the proportion of senior underwriters is 27.1%. The data are generally described and

classified, as shown in Table 2 below. As shown in Table 3, approximately 28.4% of VC firms in our database target fewer industries (the so-called specialization indicator variable). For

example, Wanjiang Logistics Industry Investment Fund Management Company only focuses on transportation, logistics, and warehousing. IDG Capital is an early foreign investment fund that is

entering China and focusing on Chinese technology-based enterprises and technology and innovation-driven business. Widespread companies, such as Shenzhen Innovation Investment Group, also

known as Shenzhen Venture Capital, have substantial capital and a wide range of investments, focusing on manufacturing and high-tech industries and on the service industry, logistics

industry, and other fields. As VC firms grow, they expand the scope of their investments, but in terms of the average listing duration, specialized VC-invested firms perform better in the

stock market and survive longer. Approximately 56.9% of companies are backed by early-stage venture capital. In the initial development process of the enterprise, the lack of funds,

management, and experience makes the support for venture capital more demanding. Moreover, many investment companies tend to enter the enterprise in the early stage. Although the risk is

considerable, there is also a more significant profit. Early-stage VC-backed companies have a slightly higher average number of months on the market than nonearly-stage VC-backed companies

have. VARIABLE SELECTION - CORRELATION ANALYSIS Correlation analysis was performed on the selected variables, and the results of Pearson’s bilateral test are shown in Table 3. The company’s

listing survival time has a significant positive correlation with professionalism and a positive correlation with the early stage, but it is not significant. The control variables, the

company’s listing age, IPO issue scale, and lead underwriter’s reputation, are all significantly correlated with survival time. Among them, the company’s listing age is negatively

correlated, and the others are positively correlated. The industry performance indicators, which are positively but insignificantly correlated with survival time, are correlated with the

company’s listing age and the reputation of the lead underwriter. Regarding practical significance, different industries have different manifestations in the age of a company’s listing. For

example, a patent in a high-tech industry will cause the company to quickly become a monopoly in the industry, make rapid profits and grow, and meet the listing requirements. Therefore, the

listing age of enterprises is relatively young. In other words, industry performance can be reflected by the company’s age at the time of listing, so we decided to exclude industry

performance as an indicator in this paper. After industry indicators were excluded, a partial correlation analysis was performed on professionalism and early stage. The control variables

were the company’s age at the time of listing, the scale of IPO issuance, and the lead underwriter’s reputation. The results are shown in Table 4 below. Both professionalism and early stage

were positively correlated with market survival time, among which professionalism was not significantly correlated, and the early stage was significantly correlated. According to preliminary

estimates, the professionalism of venture capital companies does not influence enterprises’ sustainable development abilities, but the early stage significantly impacts these abilities. The

active time and professionalism of listed companies in the market are significantly correlated in the correlation analysis but not in the partial correlation analysis, indicating that the

net correlation between the two is insignificant after the control variables are excluded. RESULTS COX PROPORTIONAL HAZARDS REGRESSION RESULTS ON PROFESSIONALISM SPSS was used to filter and

organize the data. Among the 1372 data pieces, 116 companies were delisted and defined as events, 1255 pieces of data fit the model and were censored data, and one piece of data was censored

before the earliest event in the layer. One piece of data is censored data that appeared before the earliest delisting occurred. In this model, 1371 pieces were selected, accounting for

99.9% of the total data volume, as shown in Table 5 below. After data screening, the Cox proportional hazards regression results were obtained, as shown in Table 6 below. The overall model

aligns with the model’s assumptions; the _P_ value (_P_ = 0) is less than 0.05, and the overall model is established, indicating that the selected variables can better represent the

sustainability of listed companies. However, the coefficient of the professional variable of venture capital is negative, the _P_ value (_P_ = 0.06) is greater than 0.05, and the variable is

not significant. This result shows that the investment scope of venture capital has no significant impact on the sustainable development ability of listed companies in the market.

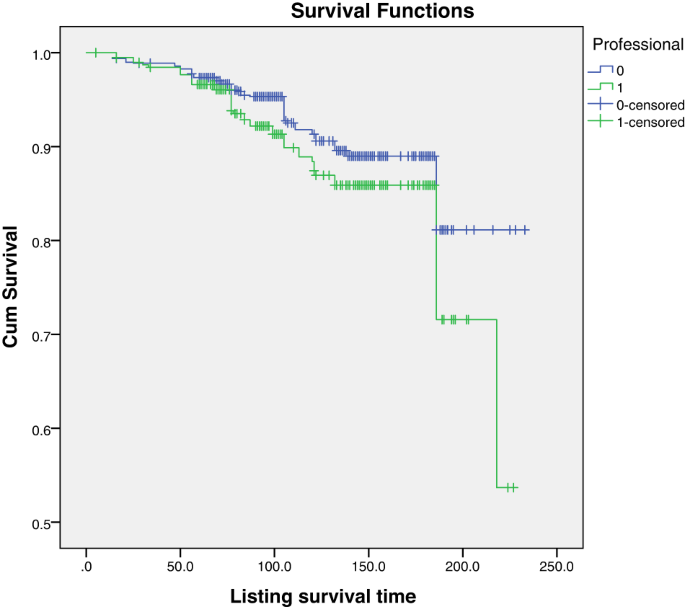

KAPLAN‒MEIER METHOD RESULTS ON PROFESSIONALISM The nonparametric analysis allows the data to speak for themselves without any fundamental assumptions about the shape of the hazard function

or the model’s covariate distribution being made. It is a suitable method for survival analysis. Therefore, the Kaplan‒Meier method was used in the nonparametric analysis for further

analysis and validation. Figure 1 below shows that the survival function of companies supported by professional and widespread venture capital companies fluctuates. The survival time of

companies supported by professional venture capital is not consistently higher than that of widespread venture capital companies. From the Kaplan‒Meier diagram, this feature of venture

capital firms that focus on fewer fields has no apparent positive effect on a company’s sustainability. The _P_ value of the log-rank test was 0.06, higher than 0.05, indicating no

difference between the two cumulative survival function curves. The results show that professional venture capital firms do not significantly impact enterprises’ sustainable development

ability. Moreover, professional venture capital firms will negatively impact later performance approximately four years after listing. This conclusion shows that the guidance of venture

capital firms on relevant professional aspects has little impact in the early stage. In the later stages of development, excessive professional intervention inhibits sustainable development.

At the same time, the time point of approximately four years after a listing is also a critical moment to which investee companies should pay attention. As shown in the survival CUM curve,

venture capital with a narrow investment scope hinders the long-term development of enterprises. With the growth of survival time, the negative effect on the survival rate increases. LIFE

TABLE METHOD RESULTS ON PROFESSIONALISM The life table method can be used to analyze large samples without too much restriction on the distribution of survival time. This method can be used

to estimate the survival rate of a specific survival time, compare the survival rates of different treatment groups, and investigate the influencing factors. We added this method to test the

results of the above two methods more intuitively. Figure 2 shows the two columns of data, namely, the proportion surviving and the cumulative proportion surviving at the end of the

interval. Professional venture capital firms’ survival rate is less stable than that of widespread companies over time. Therefore, the life table method further verifies that the

professionalism of venture capital has no significant impact on the sustainable development of enterprises after IPO (_p_ = 0.08 > 0.05), which is consistent with the results of the

Kaplan‒Meier method and Cox proportional hazard regression model. COX PROPORTIONAL HAZARDS REGRESSION RESULTS FOR EARLY STAGE As with the professionalism analysis, the model automatically

filters the data, as shown in Table 5. The results of Cox proportional hazards regression are shown in Table 7 below. The overall model is valid with a _P_ value (_P_ = 0) less than 0.05.

The coefficient of the early stage in the equation variables is positive, and the _P_ value (_P_ = 0.01) is less than 0.05; the variable is significant. That is, the early stage of venture

capital companies has a significant positive impact on the sustainable development of investee companies. KAPLAN‒MEIER METHOD RESULTS ON EARLY STAGE We use the nonparametric Kaplan‒Meier

method to verify the above results, as shown in Fig. 3 below. The survival function of early-stage VC-backed firms is consistently better than that of nonearly-stage VC-backed firms, and at

the end of the sample period, the advantages of early-stage VC-backed firms are more pronounced. From the Kaplan‒Meier diagram, this feature of venture capital firms that entered listed

companies has an apparent positive effect on the company’s sustainable development. The overall _P_ value is 0.00, less than 0.05, indicating that the two cumulative survival function curves

are significantly different. As shown in the survival CUM curve, the survival rate supported by early-stage venture capital is much higher than that supported by nonearly-stage venture

capital. With the increase in survival time, the difference in survival rate increases. LIFE TABLE METHOD RESULTS FOR EARLY STAGE Figure 4 shows the two columns of data, namely, the

proportion surviving and the cumulative proportion surviving at the end of the interval. The venture capital firm that entered listed companies earlier significantly impacts enterprises’

sustainable development capability after IPO (_p_ = 0.01 < 0.05), which is consistent with the results of the Kaplan‒Meier method and Cox proportional hazards regression model. In

summary, the results of both the nonparametric method and the semiparametric model show that the early entry of a venture capital company into an investee company significantly positively

impacts the listing survival time. From the perspective of the impact time, it is confirmed that the supervision and value-added services provided by venture capital firms benefit the later

stage of the development of the investee company. DISCUSSION Early-stage research is from the perspective of the length of the impact of venture capital. Early-stage venture capital is

conducive to the sustainable development of the investee enterprise. Moreover, the longer the time is, the more valuable it is. In addition to capital, venture capital regulation and

value-added services are the most critical differences between venture capital and other investments. The above conclusions show that the particular mode of venture capital has played a

positive role in the sustainable development of investee enterprises. The earlier venture capital assists, the more formal the investee enterprise’s management and financial system will be

(Haslanger et al. 2022). Moreover, more resources, such as contacts and news, will be available, which will be more beneficial to the sustainable development of the enterprise. Figure 3

shows that this positive effect will accumulate over time, and the gap in survival time between the early-stage investee companies and the nonearly-stage investee companies will gradually

increase. The results of this paper differ from those on the negative impact of venture capital on profit withdrawal. This paper suggests that withdrawing venture capital after listing will

only cause a short-term impact. In the long run, venture capital’s "soft power" provided to the investee companies will not disappear with the withdrawal of venture capital—these

"soft powers" better support the sustainable development of the investee companies. Professional research from the perspective of the influence scope of venture capital shows that

the professionalism of venture capital has no significant impact on the sustainable development of investee enterprises. In addition to the routine value-added services provided by venture

capital firms, professional guidance and control negatively affect investee companies. However, with the growth of survival time, venture capital with a narrow investment scope hinders the

long-term development of enterprises, as shown in Figs. 1 and 2. We analyze the reasons for insignificant professionalism from the perspective of the development needs of investee

enterprises. First, investee enterprises have obvious professional and technical advantages and more significant capital and management experience demand. Investee companies can pass through

the layers of venture capital screening and be successfully listed, indicating that the company has technical advantages. In the early development stage, enterprises aim to enlarge their

technological advantages and realize industrialization and marketization (Feng et al. 2020). In this stage, investee enterprises need more financial support and management guidance than

professional technical guidance and supervision. The professionalism of venture capital plays an essential role in the preinvestment screening process, but it does not play a prominent role

in post-IPO development. Another reason is that investee firms’ sustainable development requires them to break through industry restrictions and become industrial chain enterprises (Que and

Zhang 2021). In the later stage of development of the investee enterprise, it is necessary to communicate with upstream and downstream industries, determine a better development direction or

expand the industrial chain, and realize the upgrading and transformation of the industry. This stage requires more industry-wide experience in guidance and information collection by VC.

Therefore, a VC firm focusing on multiple fields has a relative wealth of information and other resources and will have more advantages. CONCLUSION In this article, survival analysis methods

are successfully applied to study venture capital’s long-term impact on enterprises’ sustainable development. Listed companies that have previously or currently had venture capital support

are selected as the research object. The survival analysis method can reflect the long-term impact of venture capital by taking the enterprise’s survival status and survival time as

dependent variables. We choose the professionalism and early-stage characteristics of venture capital as independent variables. These two features can reflect the length of the impact time

and the break of the impact range. The semiparametric method, namely Cox proportional hazards regression model, was used as the research model. The nonparametric methods, namely Kaplan‒Meier

and the life table method, were used to validate the conclusions. Through empirical analysis, we can draw the following conclusions. The professionalism of venture capital companies has no

significant impact on the sustainable development of enterprises in the short term. Moreover, professional venture capital firms will negatively impact later performance approximately four

years after listing. This conclusion shows that the guidance of venture capital firms on relevant professional aspects has little impact in the early stage. In the later stages of

development, excessive professional intervention inhibits sustainable development. Additionally, the time point of approximately four years after a listing is also a critical moment to which

investee companies should pay attention. Venture capital firms should avoid excessive interference in professional and technical decision-making. For investees, when choosing venture

capital, attention should be given to the investment scope of the venture capital. It is important to choose partners that align with oneself. The early stage of venture capital companies

has a significant promoting effect on the sustainable development of enterprises. Venture capital is conducive to enterprises’ standardization and long-term development because it provides

funds, supervision, and other noncapital value-added services, such as networking resources, management experience, and market information. From the perspective of the impact time, the

results show that the supervision and value-added services provided by venture capital firms benefit the later stage of the development of the investee company. The venture capital firm

should give full play to its advantages, such as management experience and human resources, and provide value-added services to cultivate SMEs’ "soft power" and help them regulate

their long-term development. If investees anticipate a demand for funds, they should choose appropriate venture capital as early as possible. This can help enterprises achieve standardized

and sustainable development. The conclusion of this article increases the trust between venture capital and invested enterprises. Venture capital enterprises and SMEs should cooperate and

leverage their advantages as early as possible. Venture capital should focus on providing advice on enterprise management, operation, and other related aspects. SMEs should focus on

achieving technological breakthroughs and ensuring market leadership. Both investment and financing parties should work together to achieve win‒win results. At the same time, the degree of

fit between venture capital firms and SMEs has been emphasized. The investment scope of venture capital refers to the scope of its social resources. The compatibility between the resource

scope of venture capital companies and the development areas of SMEs needs to be carefully considered. The main limitation of this paper is the limitation of the research sample. On the one

hand, the enterprise data used in this article are from Chinese enterprises. Most of these enterprises are listed locally in China. However, some are listed and developed in the United

States and other regions, which can show the impact of other countries. If more relevant data from more countries can be added for comparison, more conclusions can be obtained through

classification. This direction can be used for future research on the long-term impact of venture capital. Another aspect is that the research mainly focuses on listed invested enterprises.

In future research, more unlisted invested enterprises can be included for comprehensive analysis, and attention should be given to the accuracy of data collection. It is also necessary to

consider the rationality of defining long-term time. The results of this study also have implications for policy recommendations. On the one hand, the government can provide background and

policy advantages to promote venture capital development. In addition to fiscal funds and tax relief, it can provide targeted preferential policies to encourage venture capital companies to

enter the enterprise earlier. On the other hand, the government should build a bridge between investment companies and venture capital companies. It should solve the problem of information

asymmetry in the middle, reduce the high cost of information collection by venture capital companies, and promote the effective transmission of information. In this way, venture capital

companies can be more competitive. DATA AVAILABILITY All data in this article are from the Wind financial database, for which a complete and accurate large-scale financial engineering and

financial data center on financial and securities data in China has been built. The datasets generated and analyzed during the current study are available from the corresponding author upon

reasonable request. NOTES * The General Office of the State Council. Guiding Opinions on Promoting the Healthy Development of Small and Medium-sized Enterprises; The General Office of the

State Council: Beijing, China, 2019. * The General Office of the State Council. Government Working Report; The General Office of the State Council: Beijing, China, 2022. REFERENCES * Arcot S

(2014) Participating convertible preferred stock in venture capital exits. J Bus Ventur 29(1):72–87. https://doi.org/10.1016/j.jbusvent.2013.06.001 Article Google Scholar * Buchner A,

Abdulkadir M, Niklas W (2019) Are venture capital and buyout backed IPOs any different? J Int Financ Mark Inst Money 60:39–49. https://doi.org/10.1016/j.intfin.2018.12.002 Article Google

Scholar * Campbell TL, Frye MB (2009) Venture capitalist monitoring: evidence from governance structures. Q Rev Econ Finance 49(2):265–282. https://doi.org/10.1016/j.qref.2008.05.001

Article Google Scholar * Chahine S, Saade S, Goergen M (2018) Foreign business activities, foreignness of the VC syndicate, and IPO value. Entrep Theory Pract 43(5):947–973.

https://doi.org/10.1177/1042258718757503 Article Google Scholar * Chen S, He W, Zhang R (2017) Venture capital and corporate innovation: impact and potential mechanisms. J Manag World

1:158–169. https://doi.org/10.19744/j.cnki.11-1235/f.2017.01.014 Article Google Scholar * Chen Y, Xie D (2011) Network location, independent director governance and investment efficiency.

J Manag World 7(2):113–127. https://doi.org/10.19744/j.cnki.11-1235/f.2011.07.010 Article Google Scholar * Colombo MG, D’Adda D, Pirelli LH (2016) The participation of new technology-based

firms in EU-funded R&D partnerships: the role of venture capital. Res Policy 45(2):361–375. https://doi.org/10.1016/j.respol.2015.10.011 Article Google Scholar * Darrough M, Rangan S

(2005) Do insiders manipulate earnings when they sell their shares in an initial public offering. J Account Res 43(1):1–33. https://doi.org/10.1111/j.1475-679x.2004.00161.x Article Google

Scholar * Dong J, Wang L (2017) Does venture capital affect strategic choices of startups? Literature review and theoretical framework. Foreign Econ Manag 39(2):36–46.

https://doi.org/10.16538/j.cnki.fem.2017.02.003 Article Google Scholar * Dong J, Wang J, Zhai H, Wang L (2017) Value-added service or supervisory control? Management patterns of venture

capital institutes to entrepreneurial firms: views from industrial specialty and uncertainty. J Manag World 6:82-103+187-188. https://doi.org/10.19744/j.cnki.11-1235/f.2017.06.008 Article

Google Scholar * Feng B, Sun KY, Chen M, Gao T (2020) The impact of core technological capabilities of high-tech industry on sustainable competitive advantage. Sustainability 12(7):2980.

https://doi.org/10.3390/su12072980 Article Google Scholar * Feng J (2017) Analysis and countermeasures of financing problems of small and medium-sized enterprises in my country. Financ

& Econ 11:29–30. https://doi.org/10.14057/j.cnki.cn43-1156/f.2017.22.012 Article Google Scholar * Gutmann T, Jessica S, Stephan S (2019) Unmasking smart capital: how corporate venture

capital units configure value-adding services. Res-Technol Manage 62(4):27–36. https://doi.org/10.1080/08956308.2019.1613117 Article Google Scholar * Haslanger P, Lehmann EE, Seitz N

(2022) The performance effects of corporate venture capital: a meta-analysis. J Technol Transf. https://doi.org/10.1007/s10961-022-09954-w * Hensler DA, Rutherford RC, Springer TM (1997) The

survival of initial public offerings in the aftermarket. J Financ Res 20(1):93–110. https://doi.org/10.1111/j.1475-6803.1997.tb00238.x Article Google Scholar * Hsu DH (2006) Venture

capitalists and cooperative start-up commercialization strategy. Manage Sci 52(2):204–219. https://doi.org/10.1287/mnsc.1050.0480 Article Google Scholar * Jain BA (2001) Predictors of

performance of venture capitalist-backed organizations. J Bus Res 52(3):223–233. https://doi.org/10.1016/s0148-2963(99)00112-5 Article Google Scholar * Jeong J, Kim J, Son H, Nam D-i

(2020) The role of venture capital investment in startups’ sustainable growth and performance: focusing on absorptive capacity and venture capitalists’ reputation. Sustainability 12(8):3447.

https://doi.org/10.3390/su12083447 Article Google Scholar * Kelly R, Kim H (2016) Venture capital as a catalyst for commercialization and high growth. J Technol Transf 43(6):1466–1492.

https://doi.org/10.1007/s10961-016-9540-1 Article Google Scholar * Khattak MS (2019) Does access to domestic finance and international finance contribute to sustainable development goals?

Implications for policymakers. J Public Aff 20(2). https://doi.org/10.1002/pa.2024 * Klein JP, van Houwelingen HC, Ibrahim JG, Scheike TH (2013) Handbook of survival analysis. Chapman and

Hall/CRC, New York * Lancaster T (1979) Econometric methods for the duration of unemployment. Econometrica 47(4):939–956. https://doi.org/10.2307/1914140 Article MATH Google Scholar *

Loughran T, Ritter JR (2000) Why don’t issuers get upset about leaving money on the table in IPOs? SSRN Electron J. https://doi.org/10.2139/ssrn.243145 * Lu H, Tan Y, Huang H (2011) Why do

venture capital firms exist: an institution-based rent-seeking perspective and Chinese evidence. Asia Pac J Manag 30(3):921–936. https://doi.org/10.1007/s10490-011-9262-8 Article Google

Scholar * Lukas E, Mölls S, Welling A (2016) Venture capital, staged financing and optimal funding policies under uncertainty. Eur J Oper Res 250(1):305–313.

https://doi.org/10.1016/j.ejor.2015.10.051 Article MathSciNet MATH Google Scholar * Ma L, Zhang J (2013) Give full play to the supporting role of venture capital to small and

medium-sized technological enterprises. Econ Res J 9:40–43. https://doi.org/10.16528/j.cnki.22-1054/f.2013.09.017 Article Google Scholar * Mahto RV, Saurabh A, Steve TW (2018) The

diminishing effect of VC reputation: Is it hypercompetition? Technol Forecast Soc Chang 133:229–237. https://doi.org/10.1016/j.techfore.2018.04.018 Article Google Scholar * Malkiel BG

(1995) Returns from investing in equity mutual funds 1971 to 1991. J Financ 50(2):549–572. https://doi.org/10.1111/j.1540-6261.1995.tb04795.x Article Google Scholar * Meng FL, Tian Y, Han

CJ et al. (2023) Study on value symbiosis and niche evolution of the corporate venture capital ecological community for innovation and knowledge. J Innov Knowl 8(3):100363.

https://doi.org/10.1016/j.jik.2023.100363 Article Google Scholar * Militaru AMG, Fleacă B, Simion C, Popescu M (2021) The role of innovative projects for sustainable development of

enterprises. Adv Eng Forum 42:167–175 Article Google Scholar * Mingaleva Z, Shironina E, Lobova E, Olenev V, Plyusnina L, Oborina A (2022) Organizational culture management as an element

of innovative and sustainable development of enterprises. Sustainability 14(10):6289. https://doi.org/10.3390/su14106289 Article Google Scholar * Pradhan RP, Maradana RP, Zaki DB et al.

(2017) Venture capital and innovation: evidence from European Economic Area Countries. Int J Innov Technol Manag 14(6):1–30. https://doi.org/10.1142/S0219877017500316 Article Google Scholar

* Que JJ, Zhang XY (2021) Money chasing hot industries? Investor attention and valuation of venture capital backed firms. J Corp Financ 68:101949.

https://doi.org/10.1016/j.jcorpfin.2021.101949 Article Google Scholar * Ritter JR (1991) The long-run performance of initial public offerings. J Financ 46(1):3–27.

https://doi.org/10.1111/j.1540-6261.1991.tb03743.x Article MathSciNet Google Scholar * Shin H, Han I, Joo J (2022) Venture capital investment and the performance of newly listed firms on

KOSDAQ. Asia-Pac J Bus Ventur Entrep 17(1):13–28. https://doi.org/10.16972/apjbve.17.2.202204.33 Article Google Scholar * Sincerre BP, Joelson S, Rubéns F, Eduardo SF (2019) The impact of

private equity and venture capital funds on post-IPO operational and financial performance in Brazilian invested companies. Braz Bus Rev 16(1):87–101.

https://doi.org/10.15728/bbr.2019.16.1.6 Article Google Scholar * Tang W, Wu TH, Xu LH (2017) Skewness preference and IPO anomalies in China. Ann Econ Financ 18(1):173–199.

https://doi.org/10.13140/RG.2.1.1177.7527 Article Google Scholar * Tian X, Udell GF, Yu X (2016) Disciplining delegated monitors: when venture capitalists fail to prevent fraud by their

IPO firms. J Account Econ 61(2-3):526–544. https://doi.org/10.1016/j.jacceco.2015.09.004 Article Google Scholar * Vanacker T, Collewaert V, Paeleman I (2013) The relationship between slack

resources and the performance of entrepreneurial firms: the role of venture capital and angel investors. J Manage Stud 50(6):1070–1096. https://doi.org/10.1111/joms.12026 Article Google

Scholar * Wang CK, Wang K, Lu Q (2003) Effects of venture capitalists’ participation in listed companies. J Bank Financ 27(10):2015–2034. https://doi.org/10.1016/s0378-4266(02)00317-5

Article Google Scholar * Wang L, Zhuang Y (2021) Heterogeneity of venture capital and global value chain embeddedness of manufacturing enterprises. Foreign Econ Manag 43(12):135–151.

https://doi.org/10.16538/j.cnki.fem.20210419.401 Article Google Scholar * Yu J, Dong J, Deng H (2022) Does venture capital promote inter-regional capital flow? An empirical study based on

cross-regional M&A. J Financ Econ 48(1):108–122. https://doi.org/10.16538/j.cnki.jfe.20211015.202 Article CAS Google Scholar * Zhang Y, Zhang X (2020) Patent growth and the long-run

performance of VC-backed IPOs. Int Rev Econ Financ 69:33–47. https://doi.org/10.1016/j.iref.2020.04.006 Article Google Scholar * Zhao Z (2014) No mistake and having meritorious deed: the

text information in independent directors’ opinions. J Manag World 05:131–141. https://doi.org/10.19744/j.cnki.11-1235/f.2014.05.011 Article ADS Google Scholar Download references

ACKNOWLEDGEMENTS We appreciate the support of the National Social Science Fund of China (20AJY001) and the Humanities and Social Science Fund of the Ministry of Education of China

(18YJA790110). AUTHOR INFORMATION AUTHORS AND AFFILIATIONS * School of Statistics, Beijing Normal University, Beijing, China Lili Liu, Heng Jiang & Yonglin Zhang Authors * Lili Liu View

author publications You can also search for this author inPubMed Google Scholar * Heng Jiang View author publications You can also search for this author inPubMed Google Scholar * Yonglin

Zhang View author publications You can also search for this author inPubMed Google Scholar CONTRIBUTIONS LLL: Visualization, Data curation, Supervision, Writing-reviewing & editing, and

project administration. HJ: Validation, Resources, Software, and writing-original draft preparation. YLZ: Conceptualization, Methodology, and writing-original draft preparation.

CORRESPONDING AUTHOR Correspondence to Lili Liu. ETHICS DECLARATIONS COMPETING INTERESTS The authors declare no competing interests. ETHICAL APPROVAL This article does not contain any

studies with human participants performed by any of the authors. INFORMED CONSENT This article does not contain any studies with human participants performed by any of the authors.

ADDITIONAL INFORMATION PUBLISHER’S NOTE Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. SUPPLEMENTARY INFORMATION DATA

RIGHTS AND PERMISSIONS OPEN ACCESS This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and

reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes

were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If

material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain

permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/. Reprints and permissions ABOUT THIS ARTICLE CITE THIS

ARTICLE Liu, L., Jiang, H. & Zhang, Y. The impact of venture capital on Chinese SMEs’ sustainable development: a focus on early-stage and professional characteristics. _Humanit Soc Sci

Commun_ 10, 381 (2023). https://doi.org/10.1057/s41599-023-01893-7 Download citation * Received: 29 November 2022 * Accepted: 27 June 2023 * Published: 06 July 2023 * DOI:

https://doi.org/10.1057/s41599-023-01893-7 SHARE THIS ARTICLE Anyone you share the following link with will be able to read this content: Get shareable link Sorry, a shareable link is not

currently available for this article. Copy to clipboard Provided by the Springer Nature SharedIt content-sharing initiative